The 4 Foundations of Retirement

I was initially going to title this article “The 4 Segments of Retirement” as the maths behind it is more easily demonstrated in pie charts.. however while thinking about it further it becomes obvious that each of these 4 areas are indeed the foundations on which your retirement is built and supported. For many people retirement is a distant thing which slowly and predictably edges closer while being built up automatically through small pension deductions and government support. However those of us aiming for early retirement and financial independence need to look more closely at what it actually takes to achieve the retirement foundations and decide upon our own strategies for allocation of resources.

With it being a new year recently there has been alot of discussion online amongst people trying to track and categorise their own journey progress towards specific goals. Some people such as Sam over at Financial Samurai have taken things to the extreme by listing no less than 34 separate investment accounts. Others have preferred to keep things simpler such as Jason at Dividend Mantra who collates everything into a single Freedom Fund. However you decided to break down and track your asset allocations; it all condenses down into just 4 areas of investment required to build that retirement.

Housing

Unless you’re prepared to live on spare couches for the rest of your years, you will need some form of accommodation. Whether this be a fully paid-off house or money set aside to fund rent/mortgage payments, it still needs to be accumulated pre-retirement in order to fulfil the housing requirement. For a majority of people, accumulation in housing investment is built up fairly slowly over a long period of time and eventually reaches a sizeable proportion of total wealth. Some financial bloggers will argue that your home is not an investment.. and they would be right in the typical sense. However a home can be seen as an investment in that it saves you from future expense of having to rent/mortgage.

Pension

The biggest and most obvious form of retirement investment for a majority of people. While pensions have taken a publicity hit recently in the UK at least, they still remain the firm favourite way of building the retirement foundations thanks primarily due to the additions of employer contributions and tax relief. With auto-enrolment kicking off here in the UK, the government aims to ensure every working individual has access and invests into a pension fund. I’ve previously argued that I don’t think enough effort is being put towards this cause however it’s a good start. Pensions provide the security of income into retirement and can be adjusted to ensure they match inflation and support a spouse.

Investments

The most neglected of the retirement foundations but also the most important for those seeking early retirement. Investments can be in the form of company stocks, peer-to-peer lending, rental properties and any other number of things which provide an enhanced return on the initial investment amount. The major benefit of investments is that they are readily accessible and relatively free of government imposed restrictions. Unfortunately many people are still wary towards private investment due to lack of knowledge or aversion to risk.

Time

The most easily forgotten and yet absolutely essential part of building your own retirement. For the huge majority of people in western countries, time is the only factor of retirement building that they believe they have no control over. For workers at my age, 68 has been set as the age for state pension and so that is the age we must work to. A 45+ year working time investment used to build up the other 3 foundation pillars to support retirement. Except now people are realising that they don’t have to invest such a huge time commitment and can reclaim their additional years through early retirement.

How does it all add up

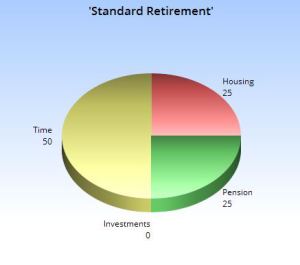

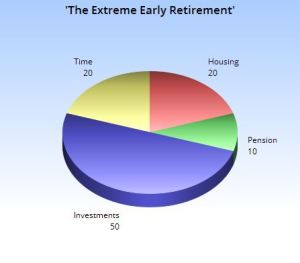

If we think of securing the necessary components to retirement as filling a pie chart, we can demonstrate the percentage segments required for different scenarios:

For most people working until state pension age, their retirement foundations will look like this. A pretty equal distribution between housing & pension plus a huge investment in time via a long working career. Investments outside of these 3 are likely to be minimal to none. This is the picture of someone who may only have a short time to actually enjoy their retirement; assuming they first survive the 45+ years of work to get there.

A familiar story for followers of some of the bigger financial bloggers. Radically reducing housing and living expenses to save large percentages of net income which are fed into investments. By reducing the living expenses, a much lower amount of investments are required to support their lifestyle and so greatly reducing the time commitment as well. Some allocation may be given to standard retirement accounts however a large non-retirement investment figure is required to bridge the years until pension access is allowed.

A comfortable middle ground with pretty equal allocation amongst all investment types. This is someone who wants to retire early but still maintain a fairly healthy lifestyle with occasional comfort purchases. By increasing investments outside of a pension account; this person is able to half their Time commitment and half the working career span, going from 45 to perhaps 23 years of work. Not extreme early retirement but still a long way ahead of the masses.

How will your foundations be allocated for your retirement? And most importantly; how much investment in time will you be sacrificing before getting there? Please let us know in the comments below.

5 thoughts on “The 4 Foundations of Retirement”

Hi Guy,

I like the concept, the 4 pillars of retirement, especially the inclusion of time in there. So by focusing on one of the other pillars (and making it stronger) we need less time and so can retire early :)

I’ll be going for the comfortable early retirement (at least that’s the plan).

Mr Z

Morning Zombie,

I think alot of people forget that giving up their time for work IS a form of investment itself.. and that by strengthening the other pillars you can reduce the reliance on time. It’s a really simple concept but I’ve hardly ever seen it mentioned anywhere else.

Comfortable retirement for me as well with a <20yr timescale hopefully.

Hi Guy,

An interesting concept, thanks for sharing it. I don’t know about you but ‘Standard retirement’ scares the crap out of me!

I contribute 2% of my salary and my company contributes 5%. If I contribute more, my company doesn’t increase, so this is the best value option I have. I’ve done a forecast of what I might earn off the back of my pension in 33 years and it’s low…… 5 figures in total. There’s no way I could rely on it. The housing is an important factor that could be overlooked, but it could help to contribute a significant sum towards your retirement, especially if you downsize.

The only real option for me is ERE, and my pie chart would have 3/4 investments, very little on my pension/home, and a chunk for time. How about you?

Thanks again

Huw

Hello Huw,

That huge chunk of time investment is pretty scary to me also! I recall when I joined my company pension scheme the default was (a pretty generous) 4% + 4% matched. I thought this was a decent amount until I ran the numbers through a pension simulator and came to a similar conclusion as you.

I’m fortunate that I’m a good 5 years younger then you and started with 0 debt which will allow me to increase the housing allocation a bit more. A fully paid off decent-sized house plus the same value again in investments should provide enough to retire on in my 40s. Not as early as you but perhaps that will change if I can get the Mrs on-board a bit more ;)

Great pie charts – really helps visualise how things can be allocated!

Myself I am going for the comfortable retirement as well. I’ll be hoping to do some freelance work or even entrepreneurship soon to give me a degree of freedom and then maybe fully retire at 45-55 depending on how things work out. Or maybe I won’t want to when I get to that age if I am running the show :)