When is the best time to start saving for retirement?

One of the most common questions I see asked online through out many financial based forums is at what age and how much someone should start saving for their retirement. Typically such threads will attract a wide range of responses which go from the prudent “half your age as a percentage” rule right up to the inevitable “don’t bother because the government will steal it all away” type responses. Although I especially enjoy reading many of the conspiracy theories around pensions being pointless and completely illogical arguments that you may as well enjoy yourself now because you’ll be working until you die.. It’s important that at least some meaningful message is able to get through.

The truth is that it’s a very difficult question to answer in pure financial terms as everyone’s situations are different and we each have differing personal aspirations. While hopefully many readers of this blog would like to retire early and enjoy their copious amounts of free time.. I’ve no doubt there are many more out there who would rather splash out on lavish holidays with the knowledge they will end up working until 70. However the important thing to remember is that you should save something and start doing so now.

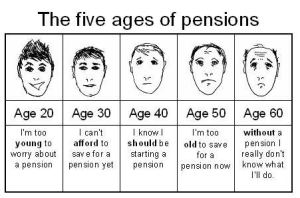

All too often I see people trying to justify their lack of retirement saving as having more important things to save for. Infact I recently stumbled upon a fantastic cartoon which nicely illustrates the point:

In your 20s the priorities are almost always housing and transport. Saving for the house deposit and paying off your first car, pensions are a distant thought. Something to worry about when you’re much older because you’re too busy getting onto the housing ladder and enjoying life.

30s come along and typically deliver children. New cots, toys, clothes and mountains of other requirements. Plus maybe a bigger car to transport the increased family around and if you’re unlucky: a house move as the previous 1-bedroomed flat isn’t going to cut it.

Before long you hit the 40s, earning a decent salary but now with teenagers who are demanding the latest gadgets and fancy holidays. You really ought to start thinking about that pension but the state retirement age is still 25 years away…

50s hit and it’s university fee time. Perhaps some grand children will come along or maybe you’ll move into that dream detached house in the countryside. By now you know you need a pension but with only 15 years left of work you’d need to put in a huge chunk of your income each month just to maintain your living style in retirement.

60s, retirement time. Children have flown the nest and you might be able to down-size your house. But will it be enough to fund your retirement? Suddenly you’re dropping from a £60k annual income to £15k. How will you fund the 4 holidays a year and 2 weekly restaurant meals you’ve grown accustomed to?

Throughout all of this, the same message appears again and again: Other things need saving for, other things need spending on. By starting your retirement saving early, you can benefit from the long investment time and compounding returns. A small regular financial sacrifice now will likely generate far greater returns than a huge sacrifice later on in life. It doesn’t have to be into a pension either. Paying off the mortgage, putting it into ISAs, getting a buy-to-let or even just saving the cash will contribute towards eventual retirement. The most important thing is to do something now.

What age did you start saving for your retirement? Do you think it was the right age to do so or do you wish you’d begun earlier? Perhaps you’ve not started yet as its something to worry about later on?

14 thoughts on “When is the best time to start saving for retirement?”

Started saving as soon as I got my job after university…. I wish I could have started earlier.

Best time to start is yesterday, second best time to start is today. It’s never too early or too late to start.

I think starting as soon as you started working full time is pretty damn good! I managed to save alot from my part time job before uni and had some left over afterwards but that mostly went on to fund my year traveling. As you say; the best time to start was yesterday.

I joined the company pension scheme at 26, which I think was the right age for me. However, what I shouldn’t have done was get into so much debt for pretty much my entire 30s, when I could have saved (and invested) a lot. As it was, I did start up a small private/stakeholder pension to supplement my company pension, but since I was still in debt when I started it and only paying in small amounts, it’s only going to be a small pot by the time I can get my hands on it at 55, but hey, better than nothing.

It’s best to start saving as soon as you’re working but if you haven’t already started, it’s never too late. Auto-enrol onto your company pension (in the UK) – the company match is essentially ‘free’ money and as it is just taken out automatically out of your wages, you won’t miss it.

Joining the scheme at 26 was certainly the right move. I remember when I was eligible to join mine at 22 there were alot of my much older colleagues who still hadn’t joined it, even though for them it would have been paying 16% company contribution for their 4%! Where else could they quadruple their money instantly?!

I only started investing in the last two years. I had my mortgage paid off by the age of 30 and then was trying to reduce my tax liability by putting as much as possible into the pension. This led me to a heap of FI blogs and 2 years later I’ve my pension fully funded*. Now I’m trying to work back from age 57 by loading up my ISAs and taxable accounts.

Overall I’m about 47% of the way to FI, but 20% of the way to ER. Fairly happy with that tbh.

*£160,000 x 25 years compounded at 5% is around £500k without further introduction of funds.

Wow, mortgage paid off by 30? That’s awesome! It sounds like you’ve got a pretty solid plan, although i’d keep an eye on inflation as it might eat into that 160k compounding if you’re not adding any more contributions. Still; you’re way ahead of me, congratulations.

Hi Guy,

Great article. The answer to when is obviously NOW. Or yesterday as Tawcan said. If people understood the real life implications of compounding, I’m sure more would start saving earlier. But most of what we see in the media wants to take our money rather than for us to save.

I started saving into the company pension scheme a few years after starting work. Wish I had just started straight away. But the burden of filling in a few forms stopped me for a few years, stupid really as they took about 30 minutes. I actually started after speaking to a colleague whos dad was an IFA and he recommended saving 20% towards retirement. That scared me into research and then into action.

Although getting into the habit of saving is probably more important, whether it be for a house, car etc. Once you can start habitually living off a smaller portion of your income, then saving for anything becomes that much easier.

All the best

Mr Z

Hi Zombie,

I completely agree that a big part of it is just getting into the habit of saving, even if it’s just a small amount to begin with and putting it towards something useful (not just saving up to buy some designer clothes). I’m so glad I joined the company scheme as soon as I was eligible and read a few online sites which recommended putting in AVCs as well. I know what you mean about the forms etc though, it does put alot of people off and the information chucked at you is very overloading. It sounds like your colleagues were far more helpful than mine.. A number of those at my company were convinced pensions were a scam and tried to talk me out of joining the generous company scheme.

That is the alternative, that pensions just feed the corporate fat cats… but what about the ‘free’ money from the employers contribution! It’s a shame so many people distrust the finance industry by default. A bit of researching and taking some ownership yourself goes a long way!

Mr Z

I’d put this another way

If you haven’t got about £250k in your joint pension/isas funds by the age of forty you aren’t going to be able to retire much before the state pension age, barring inheritance or a windfall

This will probably rise to about 70 with the next government

It’s just inevitable given the investment returns that are being projected from the current market levels

£250k by 40? That sounds like a very tall order. I think if you are mortgage free by 40 then the amount required to retire drops significantly. Investments don’t have to be in just stocks and shares, diversifying into other pots can help ride out market fluctuations.

Prior to age 35 my contribution to retirement equalled whatever contribution my employer made to my pension. I was on target to retire when the UK Government told me I could which was many years away.

Since 35 I’ve been saving 55-60% of gross earnings and am now on target to retire in less than 18 months at the grand old age of 44. This strategy which has a high savings rate and a short time period means that in all but 2 occasions savings have had more of an impact in pension pot building than investment return. I haven’t seen much compound interest (yet)…

If I could go back in time I’d slap myself in the face with a wet fish at age 22. If only I hadn’t taken on debt for a car and if only I’d started saving then I’d be Financially Independent by now.

I wouldnt slap yourself too hard.. retiring at 44 is still pretty damn awesome and will likely be earlier than myself who started properly saving/investing at 25. The fact that it’s 55-60% of gross earnings is even more impressive!

Great cartoon! It’s never too late to save, but if you do not get your plan in order soon enough, you are in deep dung.