Learning Personal Finance is like learning to swim

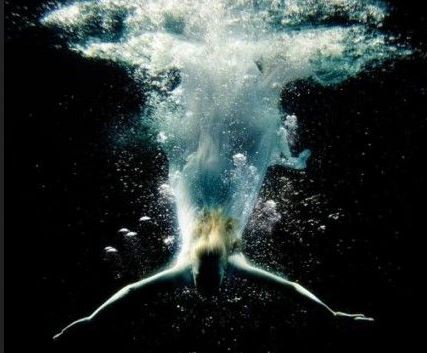

I was recently talking with a friend who mentioned that he used to be “Drowning in debt”. It’s a commonly used phrase and a situation that I’m sure everyone is familiar with; you’re kicking and struggling against the rising tides of debt until eventually you take a last gulp before being totally covered in water. In a way, alot of financial knowledge and the state you find yourself in can be related to learning to sink or swim through your personal finances.

Baby under water

Have you ever been to a local pool while a mother & baby swimming session is going on? In what seems like complete insanity, the mothers will dunk their babies underwater in what appears to be a synchronised mass drowning attempt. The first time I ever heard about this I thought one of my friends was winding me up. I mean, if adult humans drown all the time.. what chance has a baby got? But they do survive and come back up smiling if looking a little dazed too. Apparently for the first 6 months of life, humans have a natural ability to hold their breath and survive the short underwater bursts.

This automatic response to danger can also be used to apply to our very first interactions with personal finance. When you’re a child, your income relies solely on being obtained from generous parents or family. If you have £1 and go out to buy some sweet.. you can only purchase £1 worth. After this; your money is gone and your spending instantly stops. For children, there are no credit cards or payday loans. Debt doesn’t really exist for them and so when the money stops they simply hold their breath until they bob back up to the surface and receive the next week’s pocket money.

Doggy paddle

As you get older, you might start swimming lessons either voluntarily or through primary school (unless you forgot to bring in the £2 contribution). The first stroke you’ll learn is to doggy paddle. Clumsy, tiring and messy.. you’ll move at the speed of a snail while frantically trying to keep your head above water. Luckily the pool is shallow and there’s plenty of flotation devices around to cling on to.

This could well be our young adults, moving away to university for the first time or working in a relatively low paid job whilst trying to maintain an extremely active social life. Budgeting, borrowing and personal spending are all new experiences and many find themselves frantically paddling away underwater to make the limited finances stretch. Much like the young child learning to swim; the water is shallow as it’s often difficult for young adults to obtain huge amounts of credit.. and there’s still flotation aids bobbing around in the form of a parental bailout. Nobody can learn to master the advanced swimming strokes without at one point having to doggy paddle and it’s the same with learning to control your finances.

Swimming lengths

You’ve mastered a few basic strokes and can keep above water without clinging on to a float. Now is the time to move on to the main pool and start swimming the distances. You’ve got a job, a regular income stream from which you can spend each month to keep propelling forward. Some people will be naturals at this, they’ll begin with short lengths in a smaller pool before progressing into the bigger one while enjoying the experience and stopping before they get too exhausted. These people are our financial accumulators, keeping their income steady and their expenditure in check.

Unfortunately here also is where some swimmers start to get into real trouble. Perhaps they’ve misjudged their own ability and jumped straight into the deep end? Or they’ve continued way past their endurance level and have exhausted themselves? These people may be treading water, keeping their head up and appearing calm above the surface but frantically kicking below. This would be someone who is spending more than they earn, or even worse; borrowing money with no repayment strategy. How long can this be sustained before they’ll eventually dip below the water line and drown in debt?

Mastering the dives

The final swimming lesson most people learn is to swim confidently underwater. Diving in from the pool edge gives a much faster start and is a far more efficient use of energy. Only those who have completed all the previous steps will be able to swim underwater with the confidence that they can come back up for air whenever it’s required.

If the water represents debt, those diving into it for a head start would be someone taking on debt for a specific and financially sensible purpose. Purchasing your first home to save on rent and using a 0% interest credit card to collect the cashback rewards are excellent examples of someone diving into debt in a controlled and useful way. They know why they are underwater, had planned to be there and are confident that they will be able to surface at the end of it.

Have you learnt to swim your way through personal finances? Or are you just threading water hoping for someone to throw you a life jacket?

6 thoughts on “Learning Personal Finance is like learning to swim”

Really interesting correlation between PF and swimming. I enjoyed reading this! Particularly as there is somewhat of a correlation in my own PF and swimming journeys… You see, I learnt to swim by accident. I was at our local pool, at a school swimming lesson when it happened. I was holding onto the bar and had my feet tucked up. I was bobbing up and down and suddenly something happened. I slipped backwards and suddenly floated away from the edge, on my back. However, since I instantly realised I was floating and I was actually not dead, I just started to scull my arms and kick my feet gently. Wow. I could ‘sort of’ swim!

In terms of my PF, I was not drowning in debt, but after having been made redundant, I did have a few grand in debt from a personal loan I used to buy an essential car for one of my first jobs (working in middle of nowhere). However, I managed to get a payment plan sorted and was paying it back even through uni when I had such a low income. Eventually managed to get the remainder of the debt wiped, yipee!

Thanks for an interesting article – really good comparison!

Cheers

Thanks M!

It’s interesting that most people will actually float with very little effort at all, just staying calm and flat.. however when people start to feel themselves going under they panic and make things worse. I’ve had to dive in to rescue a child in the past who was about 10cm away from a float but was panicking too much to reach out and grab it.

Great comparison.

Also remember that just like no-one becomes an overnight swimming sensation you don’t wake up one day as a omnipotent finance guru. It’s about practice, experience and dedication. The same qualities you need to succeed in early retirement are no exception. Thankfully most of us have started early enough that we have plenty of time to develop our stroke!

Exactly Fibrarian :)

Great Analogy! (and that’s from someone who’s only just broken back through the surface!)

I share with Martin Lewis the idea that as people have swimming lessons they should also receive financial education in school – would hopefully prepare young adults against the dangers of not knowing their limitations…

Guess this adds whole new meaning to payday loan companies being the next best thing to loan sharks :-)

MikeS