Stop Complaining and Start Doing

House prices have gone up in this country, there’s no denying that.. however the hysteria that has accompanied the raise seems to have grown exponentially in comparison.

On a forum I visit aimed towards students and young adults, A thread was created asking the question:

How many of you realistically think that you will become a homeowner before 30?

What followed was the inevitable stream of despair and complaints ranging from lack of parental support to the state of the economy. The general consensus was clearly that few if any of these bright young minds genuinely believed that could achieve home-ownership by 30. What?!

I’ve always believed in fighting arguments with facts and so lets examine some of the whiny complaints and see if we can’t inject some logic.

‘House prices have sky rocketed, They’re totally unaffordable now’

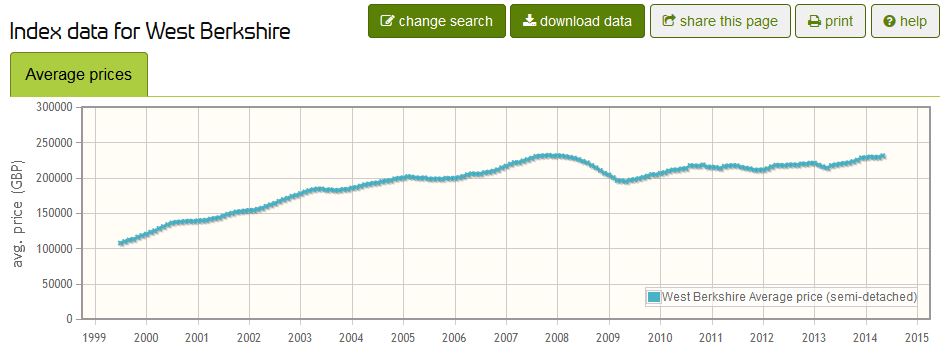

A real classic this one, and one that has actually been around for a long time. Young adults frequently use this excuse to justify being unable or unwilling to save for a house deposit. Comparing the value of an average semi-detached house in my home county of Berkshire between now and 15 years ago:

July 1999 – £107,582

July 2014 – £231,194

A large increase on paper, however this completely ignores inflation over that period. Taking into account the inflation over that time, the difference looks more like:

Jule 1999 – £165,310

July 2014 – £231,194

Difference: £65,884 or 33.2% increase

Hardly a sky rocket increase over 15 years. Infact that original £165,310 invested and with an averaged 4% compound (after inflation) in the stock market would now be worth £297,713!

‘I never have any money left over each month to save’

Have you ever noticed that the people who cry this most often are usually the ones that have written it from their iPhones or laptop from inside a Starbucks? Saving for a house deposit is hard, it’s supposed to be hard! When I was saving for my house deposit I had a £10 pay-as-you-go phone, never went abroad for holidays and spent evenings watching films with friends at home. I shared a run-down rental with a couple of friends and walked/biked everywhere. This allowed me to save the entire house deposit + fees in just 3.5 years on my own.

Making a few sacrifices in your life will compound into a much bigger total. For example:

£50 per month iPhone contract

£50 per month Sky package

£200 per month on takeaways and drinks in town

This gives a cool £300 a month, totaling over £10,000 in 3 years.. more than enough for a house deposit on a reasonable starter home and without even beginning to look at other areas to cut back on like transport and shopping.

These people need to stop complaining and start doing!

4 thoughts on “Stop Complaining and Start Doing”

I must say I loved the title of this article. It got me to read your post and I couldn’t agree with it more. Sometimes the easiest thing to do is to complain about any situation and just sit back and do nothing about it. Be it, complaints about not having money, not being able to afford a home, complaint about the government/politics, etc. It really doesn’t matter. The only thing that does matter is taking action and doing something about it. Thanks for sharing this motivational post.

Exactly! Complaints wont get you anywhere and are just the easy option taken by so many. I find that almost all complaints can be solved with action.. it’s just encouraging people to take that action to help themselves! Thanks for stopping by and commenting, I hope we will see you return regularly :)

Having only discovered your blog recently, I’m reading all your posts and this is my favourite one so far!

I think it’s a big excuse (or even a lie) that there is no affordable housing because search on Zoopla or Rightmove and there are literally TONS of affordable properties for sale. Ok, I might be biased living in the North West, but there are Northern youngsters complaining about not owning their own properties too!

The problem I think is that of expectation – I think some of these young people have too high expectations and are expecting to be able to buy their dream 3-bedroom semi in a desirable location. For a first property, that’s just unrealistic, just like expecting a fancy sports car once you’ve passed your driving test!

For me and my friends, our first properties were only really a step up from rented student accommodation but we were on the housing ladder! As the years go by, once you can afford it, you upsize, etc.

The press goes on about Buy To Let landlords snapping up all the affordable property but the fact is, such cheaper property is being snubbed by young people in the first place, who then end up renting the property, while complaining they have no money as it’s all spent on rent….mad, eh?

The good lord put Sky subscribers on this earth to rent houses from me.

I started with £1,200 in 1989. My take home pay was £515/month and my half of the mortgage was £495! A year after buying for £81k the house was worth about £50k (1989 house price crash). Had nothing to spend and saved like mad. After years of working 2 jobs and going without, interest rates went up to 15% !!! Decades on, my portfolio is now worth millions but people tell me I’m lucky!

As for people moaning about BTL landlords buying up houses and charging extortionate rents, I tell the whingers to save up and buy a house they don’t need then rent it out cheaper.

The simple truth is that there aren’t enough houses being built for the number of people who want them. Any fool can see that. Any fool that has heard the phrase ‘supply and demand’ will know that property prices will continue to rise faster than inflation until either (a) house building increases dramatically, or (b) population falls dramatically.

There is a killing to be made in the decades to come. You just have to decide which end of the deal you want to be on. So as ERG says, stop complaining and start doing!